_960_502.jpg)

Shaun Mayberry and his family were part of the construction team in 2004 that built the industrial property at 259 Ellis Road for Engine Distributors. Shaun went on to represent the seller of this property in 2020.

A company that recycles used electronics will be creating 30 jobs over the next two years in Northwest Jacksonville after buying a 53,000-square-foot warehouse in Northwest Jacksonville at 3722 Bright Ave.

The company, E-Tech Management USA Inc, collects precious metals from used electronics and then ships them around the world, said Prime Realty broker Eric Bumgarner, who brokered the transaction between E-Tech Management and seller Antonio Estevez.

Bumgarner said the property was in complete disarray in 2014 when Estevez bought it for $150,000.

“The roof was shot, electric was ripped out, office was shot, plumbing had to be replaced and it was spray painted all over the place,” he said. “It was in about the worse condition possible.”

However, the property was still functional and Estevez used it for the past two years to run a business that refurbished printers to sell to overseas clients.

Bumgarner said that in January 2015 when he first took the assignment, Jacksonville’s industrial market was a little soft and “nothing like it is now.”

“I’d say the industrial market really started heating within the last 12 months, and once that happened we started getting a lot more interest in the property,” he said.

Benny Yeung, the owner of E-Tech Management USA, reached out to Bumgarner about another property, but the Prime Realty broker realized that Yeung’s business would work well in the Northwest warehouse. Eventually, buyer and seller agreed to a purchase price of $730,000.

Bumgarner said that Yeung, who wasn’t immediately available for comment, still got a good deal on the property as the sales price of $14 per square foot is still below what similar buildings offering the same functionality.

This building offers dock high access, outside storage, a rail spur and a 20-foot clear height. Bumgarner said buildings with similar functionality routinely are sold in the $25 per square foot range.

Also, Jacksonville wasn’t the only place that Yeung looked before deciding on 3722 Bright Ave. to buy. Yeung also looked in Savannah, but couldn’t find any property at a comparable price. Bumgarner said that some similar sized warehouses in that port city are being marketed at much higher prices.

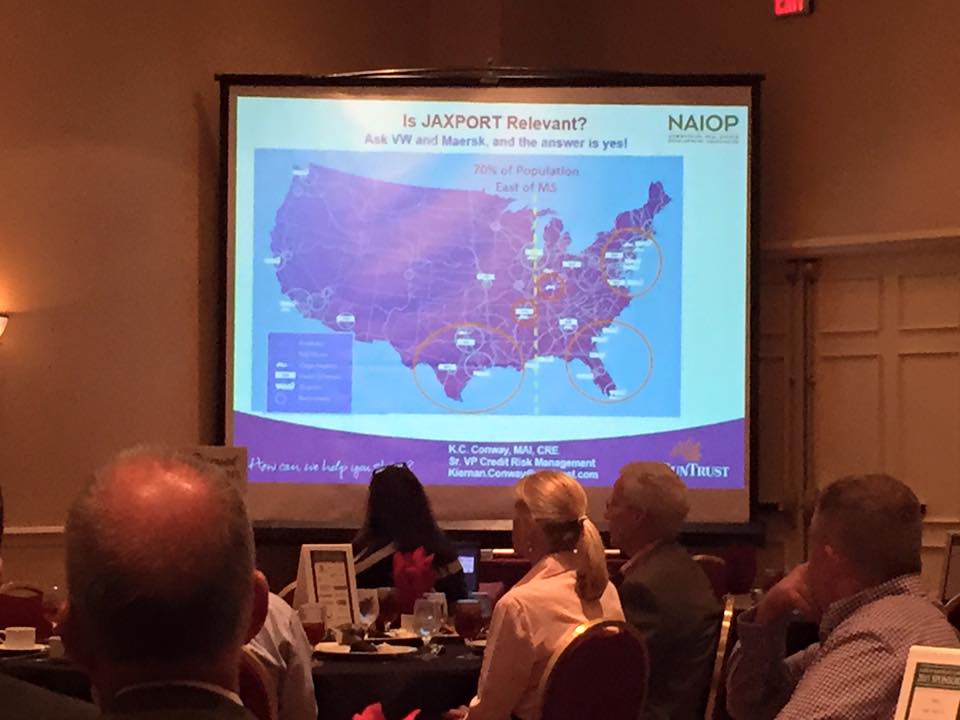

Also, Jacksonville provided other strategic advantages, he said.

• Available workforce

• Jax Port

• Cost of living

• Quality of life

• Cost of real estate

• Strategically located to reach a large portion of the US population by truck in a short amount of time

After about a month of him examining the Savannah market he made his mind up on Jacksonville, Bumgarner said.

Derek Gilliam

Reporter - Jacksonville Business Journal

Prime Realty continues to attract Chinese investors to Jacksonville during Golden Week

What is Great About Jax?! We have comprised a few recent articles about our city and all it has to offer.

Jacksonville distribution center sold for record-setting $90 million. Written by: Jacksonville Business Journal

Hillary Rodham Clinton plans later this week to propose raising capital gains taxes for some investors, pivoting from a 2008 pledge not to increase the rate beyond 20 percent. - Written by: US News LISA LERER

Article Written By: Jacksonville Business Journal

Mastering the art of networking.

Prime Retail and Prime Industrial just got a little bit bigger as we welcome Justin O’Brien and Eric Yi.

The port of Jacksonville is relevant, although it may not be for the reasons you’d think.

The Prime Realty Team Celebrates a Great Start to 2015 at The Players

There are 1,000 new Volkswagen vehicles sitting at the Port of Jacksonville, by next Wednesday, 5,000 new VWs will have made their way to Jacksonville.

Industrial players are in the midst of experiencing another phenomenal year, thanks to strong market and economic fundamentals

Congratulations to Matthew Clark, Eric Bumgarner and Team Prime!

#makeJAXhappen Prime Realty Launches Marketing Campaign Promoting Northeast Florida.

The former headquarters and distribution center for Body Central Corp. went up for sale today with a list price of nearly $5 million.

Eric Bumgarner and Joseph M. Turri have a strong Q4 2014

Favre Motorcycles is Opening Their First American Facility at Plaza 295.

Summer was a good season for Eric Bumgarner, Prime Realty, and Industrial Properties. With seventeen closed transactions so far this summer and activity picking up over the last two years, Prime Realty is anticipating a surge of industrial property sales and leases in Q4 2014 and Q1 2015.

FOR IMMEDIATE RELEASE

GU ALLSTARS IS PRIME REALTY’S NEWEST TENANT AT PLAZA 295

PRIME REALTY ASSISTS VETERAN MOVING AND STORAGE LLC COMPLETE LEASE FOR 13,500 SQ FT WAREHOUSE ON JACKSONVILLE’S WESTSIDE