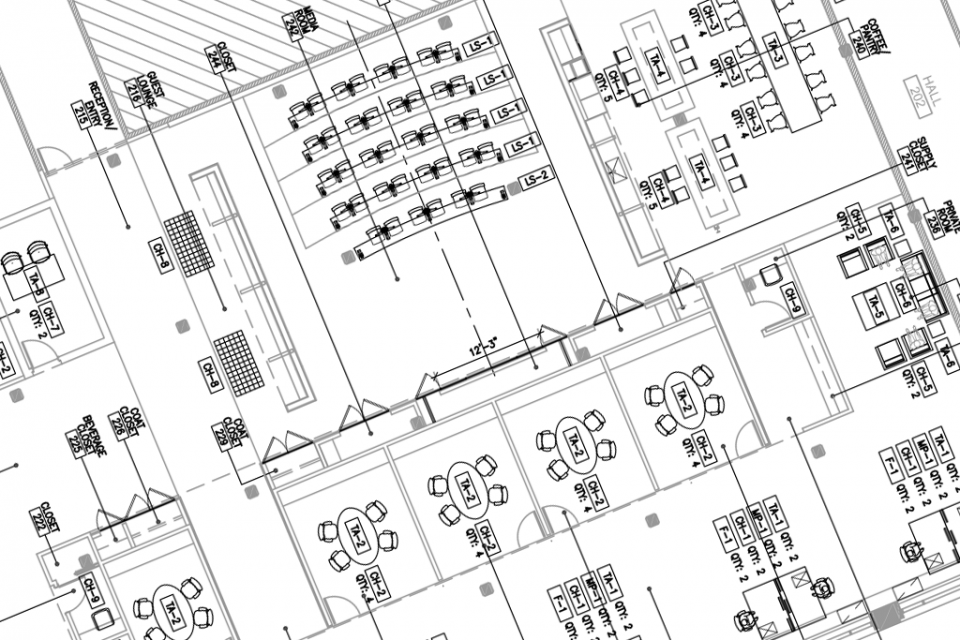

The Jacksonville chapter of CREW hosted a hardhat tour of the Laura Street trio on June 19, 2018. Our tour guide, Steve Atkins, provided insight on the project as a whole and took us through the Barnett Bank building which is currently under construction.

Top Five Tips To Leasing Your Commercial Property

Every year, the Jacksonville Business Journal honors 40 of the city’s up-and-coming leaders under the age of 40. This class of honorees is diverse, with individuals hailing from companies from Holland & Knight to Mayo Clinic to CSX. Prime Realty’s CEO Tyler Saldutti is honored to be added to this years list!

Listed are six suggestions on how a property owner can be proactive regarding insurance claims.

Freddie Mac: Increase in Multifamily Demand More than a Temporary Correction Stemming from Great Recession

By Mark Heschmeyer

Prime Realty sees the same values of focus, hard work, diversity, finishing, disciplined planning and experienced matched with talent disrupting college lacrosse the way Prime is changing the CRE industry.